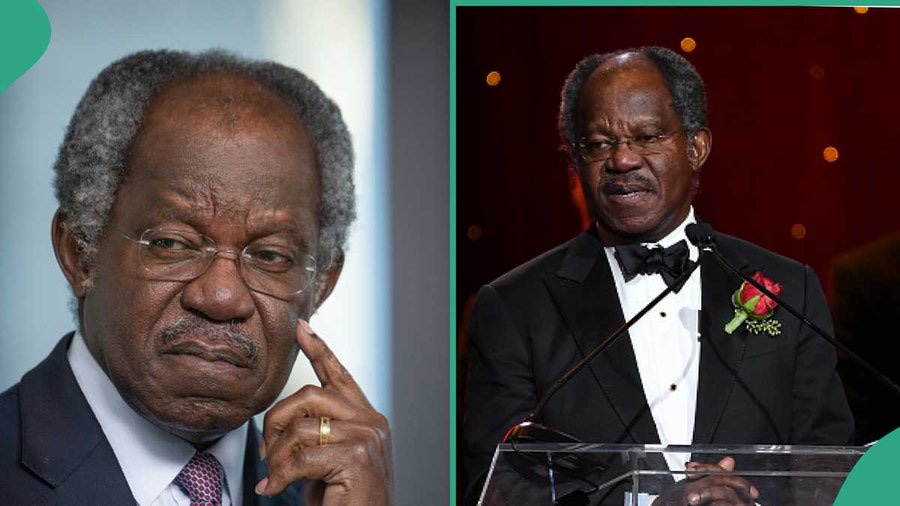

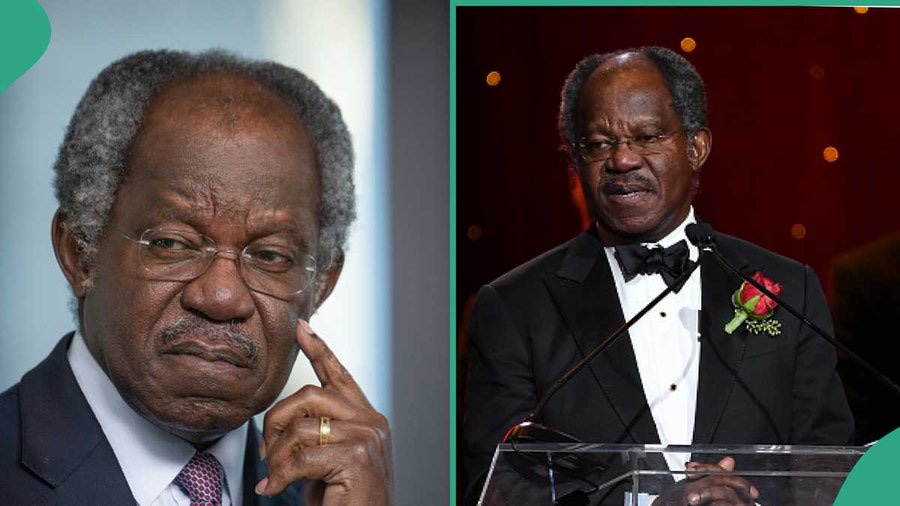

Nigerian Billionaire Adebayo Ogunlesi’s Fortune Skyrockets to $2.5 Billion After Massive $800 Million BlackRock Boost

In a remarkable leap that has cemented his place among the most influential figures in global finance, Nigerian billionaire and investment mogul Adebayo Ogunlesi has seen his net worth soar to an astonishing $2.5 billion, following a staggering $800 million windfall from his association with American investment giant BlackRock. The monumental gain comes as part of the fallout from a landmark business deal that has placed Ogunlesi firmly in the global spotlight, underscoring his influence as one of Africa’s most prominent financial minds and a major player on Wall Street.

The extraordinary increase in Ogunlesi’s wealth is directly linked to BlackRock’s acquisition of Global Infrastructure Partners (GIP), the world-leading private equity and infrastructure investment firm that Ogunlesi founded and chaired. The acquisition, which ranks among the most significant transactions in the investment sector in recent years, has been hailed by market analysts as a bold strategic move that not only expands BlackRock’s infrastructure portfolio but also reinforces Ogunlesi’s reputation as a visionary in high-stakes investment. The deal, reportedly valued at tens of billions of dollars, immediately translated into a dramatic surge in the value of Ogunlesi’s personal stake, delivering him a monumental payday that has catapulted him higher up the billionaire rankings.

Adebayo Ogunlesi, often referred to as “The Man Who Owns the Airports,” built his empire through shrewd acquisitions and transformative management of key global infrastructure assets, including major airports in London, New York, and other strategic international hubs. His firm, GIP, has long been a dominant force in infrastructure investment, managing assets across the energy, transport, and utilities sectors. Known for his ability to spot undervalued assets and extract maximum value from them, Ogunlesi’s track record has earned him respect from Wall Street heavyweights and policy makers alike. This latest financial surge is a testament not only to his business acumen but also to the growing global recognition of the infrastructure sector’s central role in the modern economy.

The boost from the BlackRock deal has also reignited conversations about Ogunlesi’s remarkable personal journey from Nigeria to the pinnacle of global finance. Born in Ibadan in 1953, Ogunlesi’s early life was marked by academic brilliance and a relentless drive to succeed. After earning his first degree from Oxford University, he went on to attend Harvard Law School and Harvard Business School, an unusual double feat that equipped him with a rare combination of legal and financial expertise. His career took him to the highest levels of banking and investment, including a tenure as Head of Global Investment Banking at Credit Suisse, before he struck out on his own to found GIP in 2006.

Since then, Ogunlesi’s trajectory has been nothing short of meteoric. Under his leadership, GIP transformed into one of the most respected investment firms in the world, managing assets worth over $100 billion and attracting some of the world’s most sophisticated investors. His ability to negotiate complex deals, navigate turbulent markets, and maintain an unwavering focus on long-term value creation has made him a sought-after figure in corporate boardrooms and international economic forums. The BlackRock acquisition has now placed him in an even stronger position to influence the future of global infrastructure investment, with industry watchers predicting that his strategic insight will continue to shape the sector for years to come.

The $800 million gain also reflects the growing importance of infrastructure as a cornerstone of investment strategies worldwide. In an era where governments and private investors alike are grappling with the challenges of aging public assets, climate change, and rapid urbanization, firms like GIP—and now BlackRock—are at the forefront of financing and managing the large-scale projects that keep economies moving. Airports, power plants, pipelines, and transportation networks require massive capital, and Ogunlesi’s proven ability to manage such assets effectively has made him an indispensable figure in the global investment landscape.

For Nigeria and Africa as a whole, Ogunlesi’s latest success carries symbolic weight. While he has spent much of his career abroad, his achievements are a reminder of the immense potential African talent holds on the world stage. At a time when the continent continues to struggle with economic challenges, Ogunlesi’s rise serves as both inspiration and proof that African-born entrepreneurs and professionals can not only compete but thrive at the highest levels of global commerce. His journey is particularly significant for the younger generation, who see in him a role model that demonstrates the power of education, discipline, and strategic thinking.

The billionaire’s newfound $2.5 billion fortune is also expected to amplify his philanthropic impact. Though not as publicized as some of his peers, Ogunlesi has been involved in various charitable initiatives over the years, particularly in education and social development. With his latest windfall, speculation is growing that he may expand his philanthropic footprint, potentially channeling more resources into causes that address infrastructure deficits in Africa and support opportunities for the next generation of leaders.

Market analysts believe that the BlackRock-GIP merger will have long-term ramifications for the investment industry. By integrating GIP’s specialized infrastructure expertise with BlackRock’s massive asset management capabilities, the combined entity is expected to become a dominant force in global infrastructure financing, creating new opportunities for large-scale projects worldwide. For Ogunlesi, who will remain actively involved in the new setup, the deal provides both financial reward and an expanded platform to shape the future of one of the most critical sectors of the global economy.

Reactions to the news of Ogunlesi’s wealth surge have been overwhelmingly positive, with social media flooded by congratulatory messages from Nigerians and well-wishers across the globe. Many have expressed pride in seeing a Nigerian-born financier reach such extraordinary heights, while others have drawn lessons from his discipline, persistence, and strategic brilliance. The announcement has also sparked renewed interest in his career story, with many Nigerians delving into his past interviews, speeches, and public appearances to glean insights from his professional journey.

In a world often dominated by the names of Silicon Valley tech billionaires, Ogunlesi’s story stands out as a reminder that wealth and influence can also be built in sectors like infrastructure, where tangible assets and long-term value creation underpin success. As his net worth now stands at $2.5 billion, the Nigerian billionaire remains proof that strategic vision, patience, and bold decision-making can yield results that not only change personal fortunes but also reshape entire industries. With the BlackRock deal marking a new chapter in his already illustrious career, it is clear that Adebayo Ogunlesi’s influence in global finance is far from reaching its peak, and the world will be watching closely to see what this infrastructure titan does next.