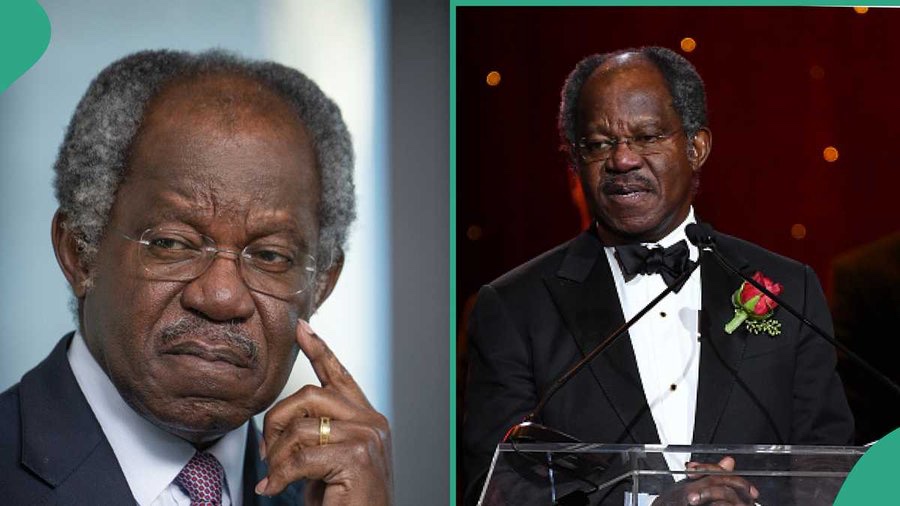

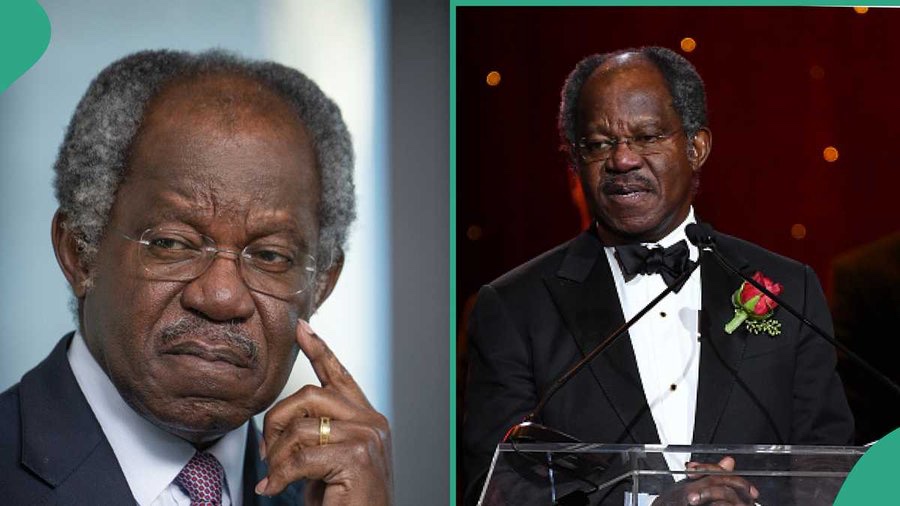

Adebayo Ogunlesi: The $2.5 Billion Nigerian Powerhouse Redefining African Wealth

In a world where African billionaires are often boxed into oil rigs and telecom towers, Adebayo Ogunlesi has rewritten the script.

The Nigerian-born lawyer and investment banker has surged to a staggering $2.5 billion net worth, thanks to an $800 million windfall from BlackRock — the world’s largest asset management firm with over $10 trillion under management.

The payout follows BlackRock’s 2024 acquisition of Global Infrastructure Partners (GIP), the firm Ogunlesi once chaired and transformed into one of the most influential infrastructure investment platforms globally.

For decades, he has navigated the corridors of high finance with a rare blend of Harvard-trained legal intellect and Wall Street investment savvy, having previously served as head of investment banking at Credit Suisse.

Ogunlesi’s meteoric rise stands as a powerful counter-narrative to the continent’s wealth stereotypes. His fortune is not tied to crude oil fields or mobile phone empires, but to global-scale finance and infrastructure — sectors that demand patience, precision, and a mastery of complex deal-making.

It’s the kind of career arc that inspires both aspiring African entrepreneurs and seasoned investors looking beyond traditional markets.

The timing of his financial leap aligns with Nigeria’s shifting economic pulse. Nairametrics’ H2 2025 Outlook points to robust non-oil sector growth — exactly the economic terrain where Ogunlesi has thrived.

Analysts argue his trajectory could be a blueprint for Nigeria’s future: a pivot towards sectors that are globally competitive and less vulnerable to oil price shocks.

For many Nigerians, Ogunlesi’s success is more than a personal triumph — it’s proof that African talent can shape the commanding heights of global finance.

In a time of currency fluctuations and fiscal uncertainty, his story is a reminder that wealth can be built not just from the ground beneath our feet, but from the vision to invest in the roads, ports, and energy grids that connect the world.